Lucapa Finds 104ct. Diamond at Lulo Mine

Lucapa Diamond Company recovered a 104-carat, D color diamond. The type IIa stone is the fourth rough[…]

Laboratory created diamonds submitted to the DCLA

Tuesday 20th September. Two diamonds submitted to the DCLA laboratory by a Sydney jeweller were identified as[…]

HRD Uncovers Tampered Diamond Grading Reports

HRD Antwerp has invalidated 156 diamond grading certificates and fired three employees who accepted a financial incentive[…]

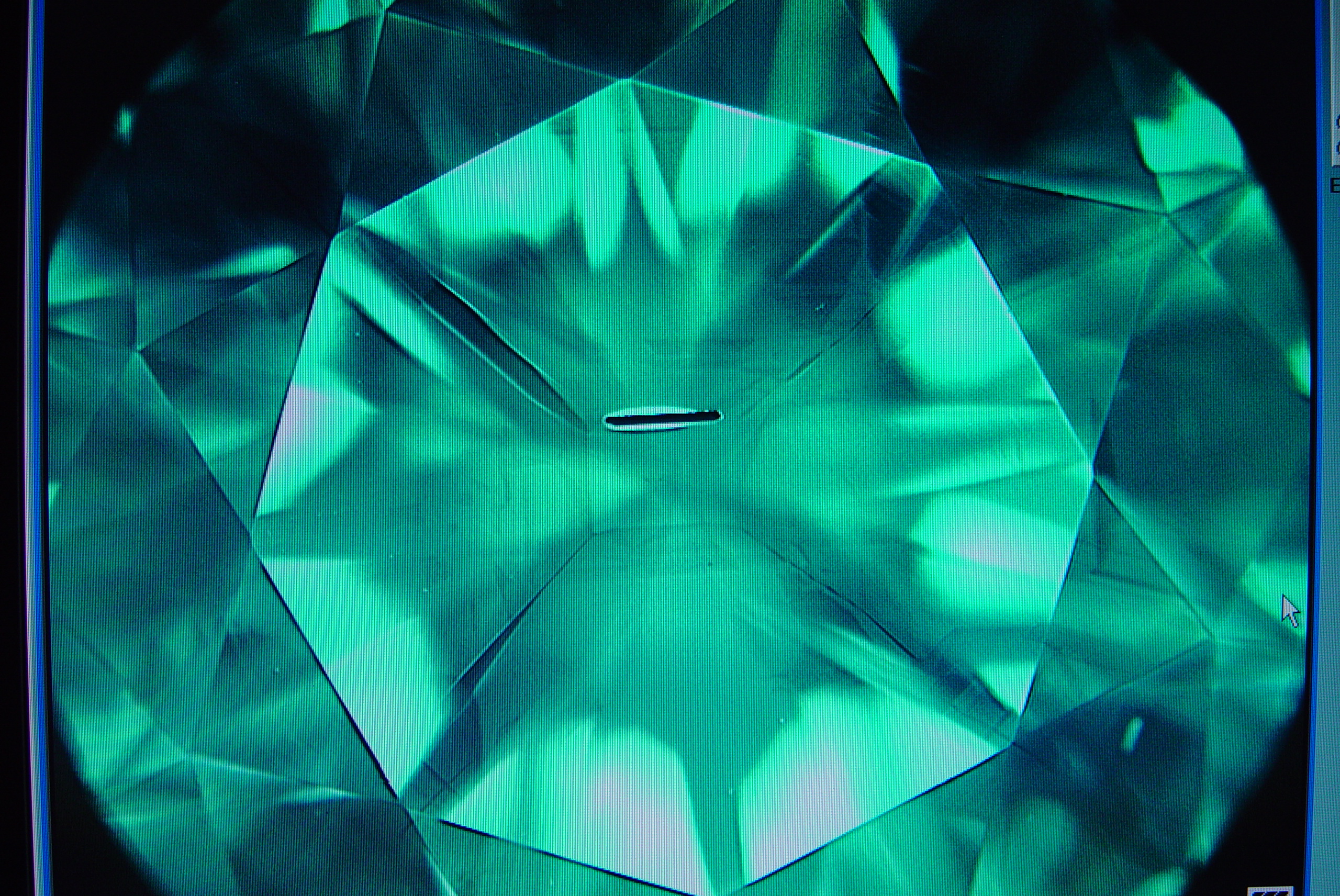

138.57 Carat D Colour Diamond Recovered by Petra at Cullinan

Petra Diamonds announced that it had recovered a 138.57 carat

Swarovski Jumps Into the Lab-Grown Diamond Business

Swarovski, the Austrian company famed for its signature crystals, is now selling synthetic diamonds. A Swarovski spokesperson[…]

Short term loans on certified diamonds and jewellery.

DCLA verification, loan valuations of your diamond or diamond jewellery. DCLA in conjunction with Assetline are now[…]

Graff Reveals 105ct. Flawless Diamond in Paris

Graff Diamonds unveiled 105.07 carat pear shaped D If diamond cut and polished by Graff. The rough[…]

Petra Diamonds recovers 121.26 carat white diamond

Petra Diamonds has found a large 121.26 carat white diamond at the Cullinan mine in South Africa.[…]

Before you sell your diamonds and gold for cash call for advice

We help you get the best price for your Diamond Jewellery We buy Gold and silver Bullion[…]

Sotheby’s Shares Ownership of $72M Pink Diamond

Sotheby’s teamed up with two other firms to collectively own the Pink Star diamond, which has been[…]