The Tanzanian government has announced the seizure of diamonds worth an estimated $29.5 million after accusing British company Petra Diamonds, of undervaluing the worth of the gems.

Minister of Finance Philip Mpango stated on Sunday that he had “nationalized” these diamonds, extracted from the Williamson Diamonds mine, 75% owned by Petra Diamonds and 25% by the Tanzanian government.

The diamonds were seized on 31 August at the Dar es Salaam International Airport while being exported to Belgium.

According to the Tanzanian authorities, Williamson Diamonds’ documents indicated an estimated cargo of $14.7 million, while the actual value of diamonds, deliberately undervalued, was $29.5 million.

“Williamson Diamonds documents give these diamonds a value of $14.7 million (pre-market) while the actual value is $29.5 million,” the Finance Ministry said in a release Saturday.

On Thursday, two former senior mining officials, quoted in parliamentary reports on alleged embezzlement linked to diamond mining and trading, resigned on the orders of President John Magufuli.

Former Minister of Mines, George Simbachawene, who until his resignation was Minister of State for Local Government, and the former head of the National Mining Company (STAMICO), Edwin Ngonyani, Deputy Minister of Public Works and Transport until Thursday.

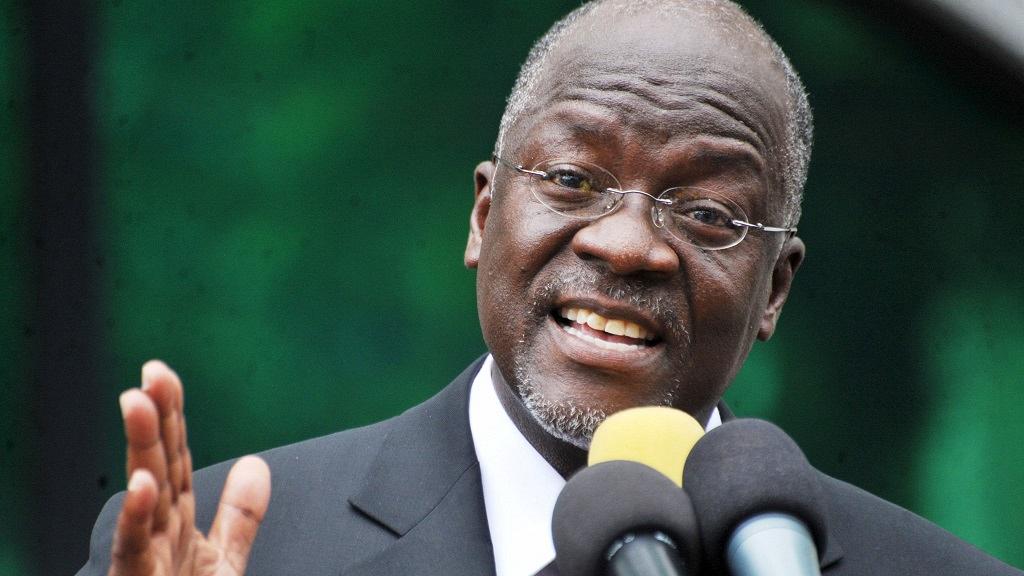

The two ministers resigned at the orders of President Magufuli, who had just received the findings of two parliamentary reports that put them in question.

President Magufuli demanded that all current government officials be blamed for this case and leave without waiting for them to be dismissed.

Nicknamed “Tingatinga” (bulldozer in Swahili), President Magufuli has marked the spirits since taking office at the end of 2015 by being inflexible in the fight against corruption.

He hired a tug of war with the large foreign mining companies operating in Tanzania, after a parliamentary report accused them of dumping their production, resulting in a tens of billions of dollars in taxes and royalties since 1998.

But Mr. Magufuli’s unconscious and abrupt style also earned him the title of autocrat and populist by his detractors, while freedom of expression is increasingly reduced in the country.