The just completed Sotheby’s Magnificent Jewels sale in New York is the first auction to sell two items for more than $30 million.

The first is the “Estrela de Fura,” a 55.22-carat Mozambique ruby that sold for $34.8 million ($630,288 per carat), establishing a world record price for a ruby and any colored gemstone sold at auction. It is also the largest ruby to be sold at auction. Its pre-auction estimate was more than $30 million.

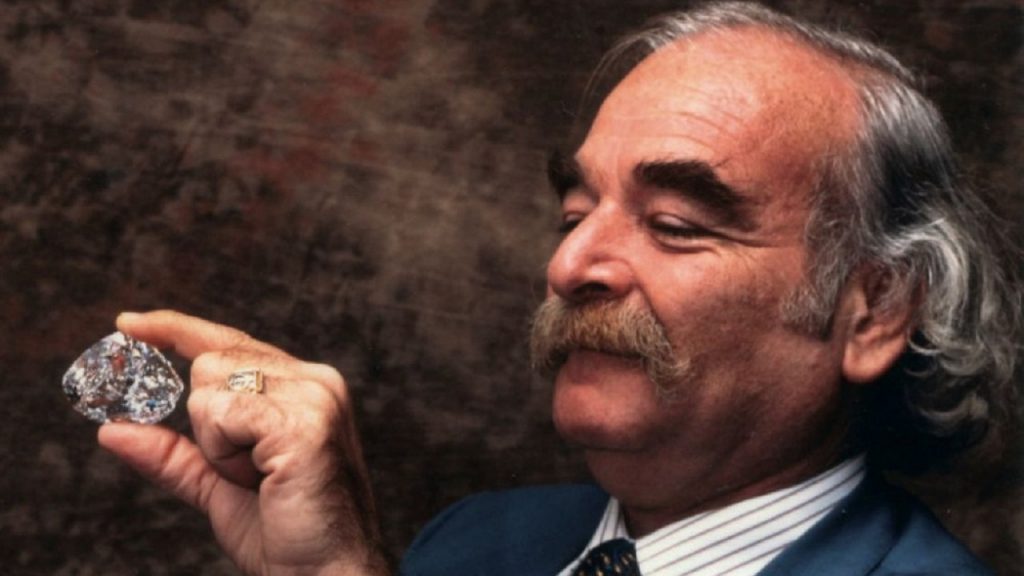

The finished ruby was cut and polished from a 101-carat rough discovered by Fura Gems, a colored gemstone mining and marketing company based in Dubai. It was unearthed at its ruby mine in Montepeuz, Mozambique, in July 2022. The company named the rough gem, Estrela de Fura (Star of Fura in Portuguese). Even in its rough, untouched state, the ruby “was considered by experts as an exceptional treasure of nature for its fluorescence, outstanding clarity and vivid red hue, known as ‘pigeon’s blood’ — a color traditionally associated only with Burmese rubies,” Sotheby’s said in a previous statement.

It’s rare for a mining company to cut and polish the gem and then sell it at auction. The usual route of recently found colored gems is to sell it to a company as a rough where they would cut and polish the gem, then it would sell it privately or at auction. However, Dev Shetty, founder and CEO of Fura Gems, chose to not only go on the auction route on his own, but to embark on a worldwide tour of the rare gem, promoting not only this stone, but rubies from Mozambique as equal to rubies from Burma, which has historically been considered the main source of the most sought-after rubies.

Quig Bruning, head of Sotheby’s Jewelry America, previously said the Estrela de Fura may signal a change of this perception.

“It is undoubtedly positioned to become the standard bearer for African rubies – and gemstones in general, bringing global awareness to their ability to be on par with, and even outshine, those from Burma,” Bruning said in a statement.

Source: forbes.com