When it comes to buying that dream diamond, most people are unsure of what to look for. Buying that perfect diamond is not a low-cost exercise, with an average selling price of $16,000 for a 1 Carat quality diamond ring. Making sure that you make the correct choice for your budget is vital in making any diamond purchase.

Here are some tips from Australia’s diamond experts at the DCLA.

The Diamond Shape:

The shape is the first and most important decision to make when purchasing a diamond as this sets the design of your jewellery piece. The diamond shape sometimes referred to as cut, is the geometric appearance of the stone. The shapes are categorised into two groups for pricing, round diamonds, and fancy shape diamonds.

Round Diamonds

Round brilliant cut diamonds are the most traditional and popular diamond shape consisting of 57 facets top and bottom. Almost 75% of all manufactured diamonds are round.

The diamond shape is 100% symmetrical when polished and having an excellent grade will display a range of features helping the crystal reflect light.

Round diamonds are the only shape that has a proven proportion or cut grade, which shows the optimum angle for a diamond to return the right amount of light back to the viewer.

This grade is based on light tracing. This is the way light refracts through the crystal, then reflecting off the facets and returning to the table and crown.

Fancy Shape Diamonds

Fancy shape diamonds refer to all diamonds other than the round brilliant shape.

These include the traditional shapes like pear, emerald, oval, marquise, cushion, heart and asscher. As well as the newer modern cuts like the princess, trilliant and radiant.

The modern fancies have become popular with cuts like the square radiant and Princess have remarkably high light return due to symmetry, facet design and placement.

These stones have similar brilliance to the round due to faceting. Facets start at the girdle (outer rim of the stone) and run down to the culet (point at the bottom).

The step cuts like emerald shape diamond are traditional as the facets run parallel to the table. These facets to create clean optical appearance.

As the step cut diamonds are less brilliant, small inclusions can sometimes be visible. To avoid visible inclusions step cuts diamond need to be of higher clarity grades, especially with centrally located high contrasting inclusions.

Fancy shapes with longer length to width ratios like marquise or pear, give a slimming effect when set correctly down the finger. The unique look of the longer stones. Oval, marquise, and pear-shaped diamond makes it a popular choice.

The square cushion shape cut in the brilliant style, has the same properties as the round brilliant and if cut with 8 main top and bottom corresponding corners (main facets) will have the Hearts and Arrows effect.

The cushion shape stone has rounded corners which make it a great alternative to a round at a lower price per carat the other of the 4C’s being equal. (Carat, Colour, Clarity).

All diamonds are unique just like you. The 4Cs Colour, Clarity, Cut and Carat weight along with many other more subtitle characteristics give the diamond its grade and set the stones value. Diamonds with the same 4C’s grade can be quite different in value due to the more subtle characteristics mostly overlooked when buying. Understanding the 4Cs along with these characteristics is a very important step in purchasing your perfect diamond.

The Diamonds Cut

The cut refers not to the shape (e.g., round, oval etc.) but to a diamond’s proportions, symmetry, and polish. The beauty of a diamond depends more on cut than any other factor as it determines how light travels into the stone and is returned to the viewer.

The cut of the diamond is arguably the most important of the 4Cs as it directly impacts the diamonds light performance. A diamonds facets are designed and placed in varied orientations and specific angles to reflect the light in a uniform way. Like tiny mirrors, each facet is precisely polished and arranged to maximize its reflective properties.

A master diamond cutter will be trained to get the most weight from the rough diamond, while getting the best light performance from the diamond crystal. This is a delicate balance not always achieved, as such the diamond proportion or cut quality should be the highest priority.

When a diamond proportion or cut grade is low, the diamond performance will let down even the highs colour and clarity. A lower colour diamond with an Excellent proportion grade will have better brilliance and fire and look better than a high colour with a good proportion.

Here are some useful terms when referring to a diamond cut:

Proportion or cut grade is precision and angle of the diamond faceting.

Symmetry is the mirror image of the stone referenced like a clock 12 – 6 and 9 – 3 as well as alignment of the facets top to bottom.

Polish is the overall finish of the skin or surface of the diamond. This includes features or characteristics like surface graining, naturals, or extra facets.

Diamond Colour

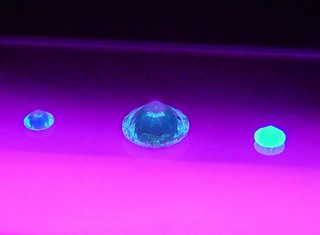

Diamonds come in every imaginable colour from pure white to any other colour in the spectrum. Many coloured diamonds are highly prized, however the presence of yellow tint in a white diamond with greatly reduce its value.

Diamonds are graded on a scale from D (colourless) through Z (light colour). D-Z are considered white (cape scale) and true fancy coloured diamonds (such as pink or blues) are graded on a separate scale.

Colour is accurately judged when viewed in laboratory conditions against a known comparison stone which are called a master set. Diamond colour distinction is so subtle that it is practically invisible to even the trained eye.

White diamonds or Cape series have formed from a carbon nitrogen bond and the more nitrogen the more yellow is visible. Very rare and completely colourless diamonds have no nitrogen and are known as type 2a. These are the most valuable.

Diamond Clarity

Diamond clarity refers to the diamond’s inclusions. Inclusions come in many variants from solid carbon to clouds or remnants of microscopic fractures all formed in the diamond billions of years ago.

The more inclusions or the larger the inclusion the lower the clarity grade. These can sometimes cause transparency issues or interrupt the refraction of light, affecting its brilliance. Most diamonds have inclusions, very few are internally flawless or pure.

Diamonds are graded for clarity on a scale that runs from IF (internally flawless) to I (included). The higher the grade, the clearer the diamond, with fewer inclusions and a more perfect appearance. The diamond clarity scale has six categories, with 11 specific grades.

Flawless (FL): There are no inclusions or blemishes visible to the diamond under 10x magnification.

Internally Flawless (IF) Loupe Clean: There no inclusions visible to the diamond under 10x magnification there may be external characteristics.

Very Very Slight Inclusions (VVS1 and VVS2): Inclusions of 5 – 10 microns or a number of smaller cloud like inclusions. Very difficult for a skilled grader to see under 10x magnification.

Very Slight Included (VS1 and VS2): Inclusions are found by experienced grades under 10x magnification, characterised as minor.

Slightly Included (SI1 and SI2): Inclusions are easily found under 10x magnification, buy not eye visible.

Included (I1, I2 and I3): Inclusions sometimes visible to the naked eye are easily found under 10x magnification. These inclusions may affect the transparency and brilliance of the diamond.

Diamond Carat

Carat or weight is the biggest contribution to the value of the diamond but is only one part in determining the value of a diamond. That said all else being equal IE: the cut, colour and clarity, a diamond’s price does increase with every size category in carat.

Rarity also determines the value of the diamond with larger stones being rarer and more valuable.

A diamond carat is the actual measured weight of the stone and due to different proportion grades, this is necessarily an indication of its size.