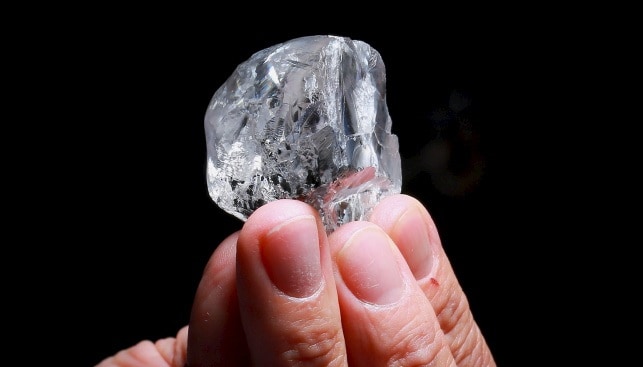

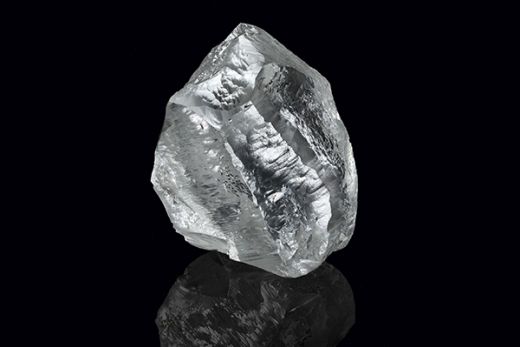

Lucara Diamond Corp. has announced the recovery of a 320-carat, 111-carat, and two +50-carat stones from its 100% owned Karowe Diamond Mine located in Botswana.

These diamonds were recovered from the direct milling of EM/PK(S) kimberlite ore from the South Lobe during a recent production run that saw additional recoveries of numerous, smaller +10.8 carat diamonds of high value.

The 320-carat is a gem-quality, top light brown diamond, while the 111-carat diamond is described as a Type IIa white stone of high quality. The two +50-carat stones add to these recent recoveries and are also Type IIa white diamonds. These recoveries add to the collection of significant diamonds recovered at Karowe and further solidifies Lucara’s reputation as a leader in the recovery of large, high-quality diamonds.

The recoveries from the EM/PK(S) unit highlight the continued success of Lucara’s mining operations at the Karowe Diamond Mine and reinforce the development of the underground mine which will target >95% EM/PK(S) ore during the first three years of underground production. The company’s adoption of advanced diamond recovery technology has enabled the continued identification and retrieval of these extraordinary diamonds and strong resource performance.

William Lamb, President and CEO of Lucara Diamond Corp., commented on the recent discoveries, stating:

“These diamond recoveries from the EM/PK(S) domain of the South Lobe further validate the quality and potential of the Karowe Diamond Mine. We are thrilled with the consistent success we continue to achieve in uncovering large, high-value diamonds, reaffirming Lucara’s position as a leading producer of large high-quality gem diamonds. Our team’s dedication to innovation and operational excellence continues to drive our success, and we look forward to delivering further value to our stakeholders through these extraordinary discoveries.”

Source: globalminingreview