Botswana Diamonds rebrands, targets copper

Botswana Diamonds (LON: BOD) will rebrand as Botswana Minerals and trade under the new ticker BMIN from[…]

How to Clean a Diamond Ring at Home – Expert Advice from DCLA Diamond laboratory

Has your engagement ring lost its brilliance? Don’t worry—your diamond hasn’t lost its sparkle. It simply needs[…]

De Beers Reports $511 Million Loss as Global Diamond Crisis Deepens

Despite generating approximately $3.5 billion in revenue, profitability deteriorated sharply, highlighting a widening disconnect between stable turnover[…]

What Is a Diamond? Natural vs Laboratory-Grown – Structure, Science and Pricing

A diamond is a solid form of the element carbon in which the atoms are arranged in[…]

Natural Diamond Engagement Ring Prices Surge in the US – What Australian Buyers Need to Know

The average price of a natural diamond engagement ring in the United States rose by 9 per[…]

Diamond Slowdown: Expansion at Gahcho Kue is “Paused”

Mountain Province Diamonds (MPD) say it has "paused" plans for a key expansion that would have prolonged[…]

Botswana’s State-owned diamond company turns to contract sales to manage tough market

otswana's State-owned Okavango Diamond Company plans to increase the share of diamonds it sells to contracted buyers[…]

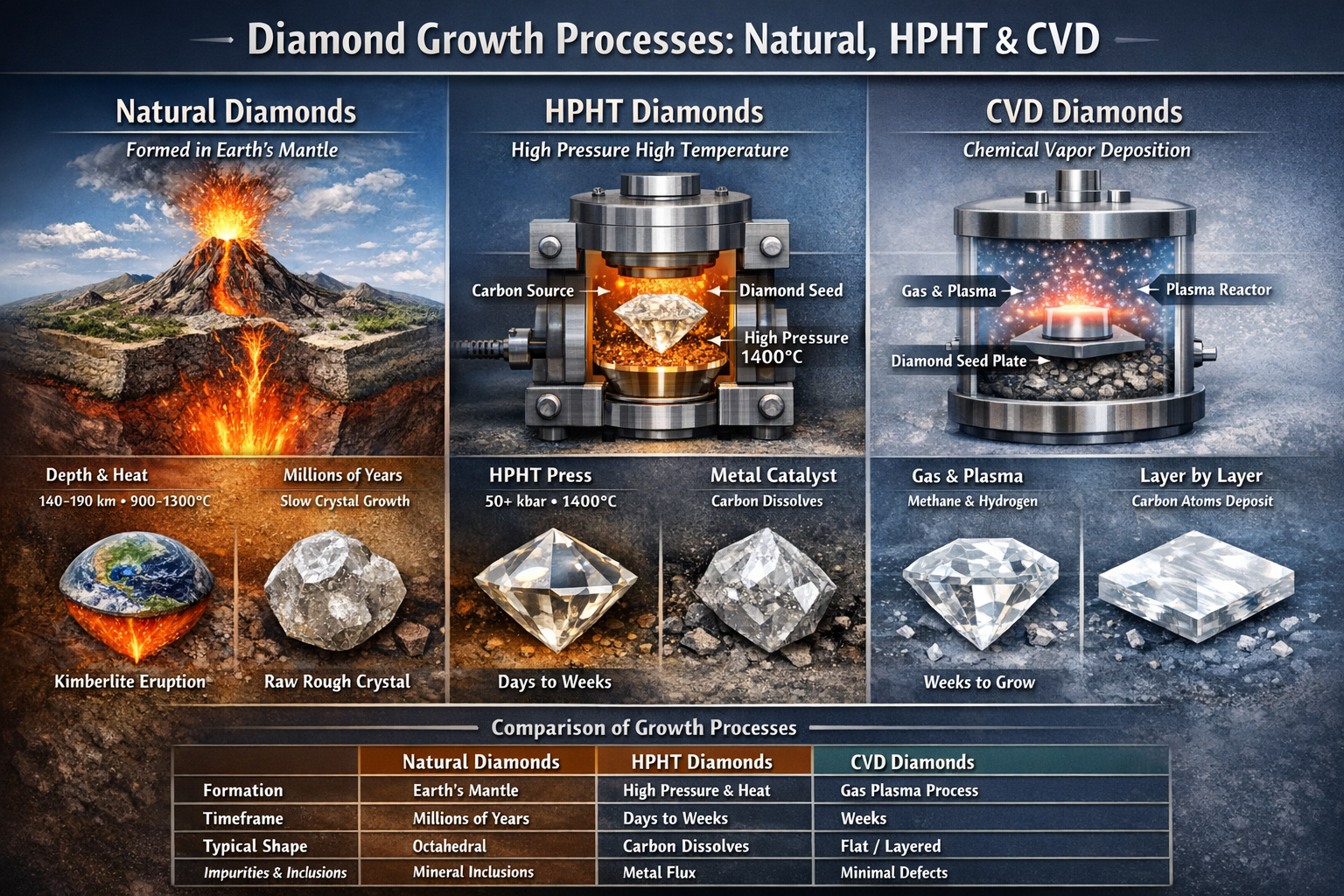

Understanding Diamond Rough Growth for Natural, HPHT and CVD Diamonds

Naturalmined, HPHT, and CVD Rough Diamonds

Historic Crown of Empress Eugénie to Be Restored After Louvre Heist

The Louvre Museum has released striking images of a historic crown once worn by Empress Eugénie, following[…]