Canadian miner Lucara has sold Clara, its digital sales platform, to former CEO Eira Thomas and a group led by the Vancouver-based HRA Group of Companies.

The move gives Clara’s new owners the freedom to sell other diamonds, in addition to those produced by Lucara at its Karowe mine, in Botswana. It also allows Lucara to focus on the underground expansion of the mine.

Thomas, who stood down last August as Lucara CEO, led the commercialization of the Clara. She said it was designed to disrupt the way diamonds are traded after a century of inefficiency and inflexibility.

Clara’s new owners – HRA and Thomas – will pay $3m in cash and return 10,000,000 Lucara common shares initially issued as partial consideration when Lucara originally acquired the platform in 2018.

“We are excited about the opportunity to realize its full potential, which remains largely unexplored,” said Aaron Ariel, managing director and original founder of Clara.

“We believe it will become the industry’s premier global rough-diamond marketplace. We look forward to partnering with stakeholders throughout the supply chain who share our vision for a healthier, more transparent, and, last but certainly not least, a more profitable industry for all.”

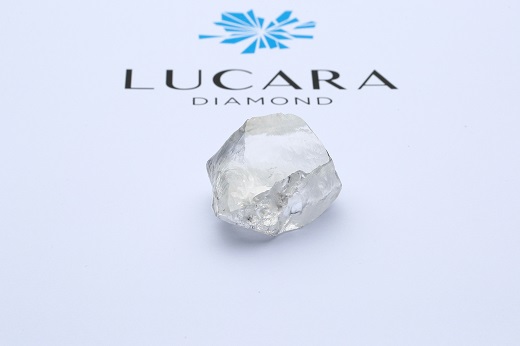

Lucara will retain a 3% net profit interest on Clara’s net earnings and has granted Clara a five-year rough diamond supply agreement for stones meeting the size and quality specifications historically sold through the Clara platform.

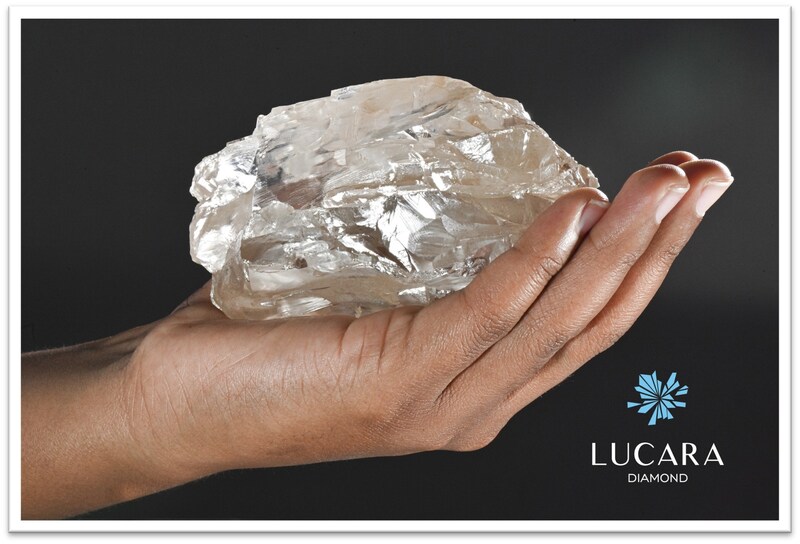

Lucara’s larger stones – those over 10.8-cts – are sold via HB Antwerp as part of an ongoing 10-year agreement. They account for around 70 per cent of the company’s revenue.

William Lamb, president and CEO of Lucara, said: “The divestiture of Clara enables us to intensify our strategic focus on maximizing returns and long-term value creation at our world-class Karowe diamond mine in Botswana.

“While the Clara platform provides an innovative digital channel for rough diamond sales, the successful onboarding of other producers’ rough production required to scale the platform, remains unattainable while the platform is owned by a pure-play diamond producer.”

Source: Idex