Behind his small and grandfatherly stature is a man who’s not afraid to say anything, and usually does. Leibish Polnauer has been in the diamond industry for over 40 years and runs an extremely successful business. But if not for a crazy fluke and a bit of luck, that business wouldn’t exist.

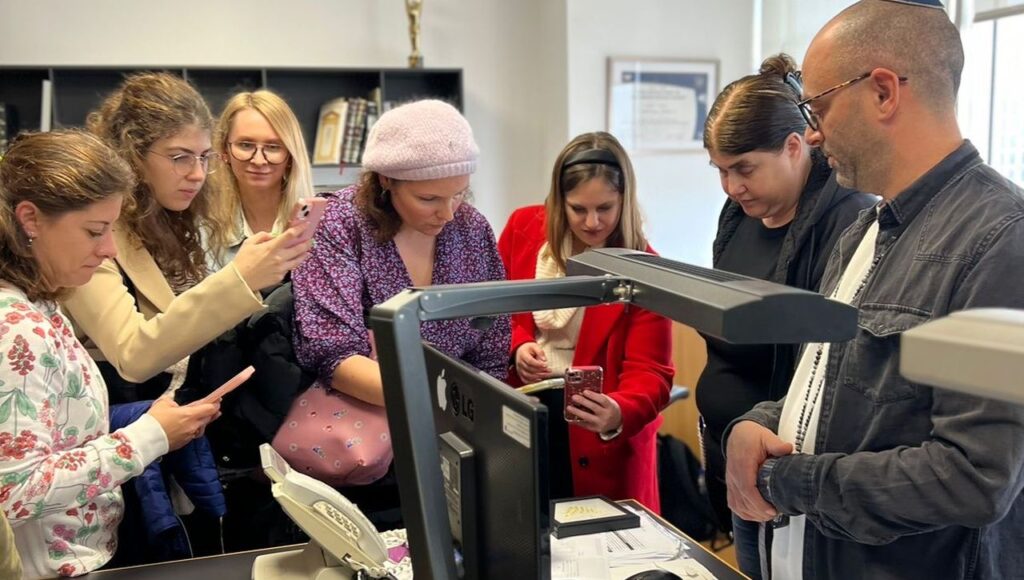

Polnauer — affectionately known in the trade as simply “Leibish” — welcomed Rapaport’s editorial team to his office in Israel’s diamond bourse to talk about how he got his start, the market for colored diamonds, what he thinks of lab-grown, and how the industry has changed over the years. We also got a sneak peek at some of the jewelry pieces his company is currently working on.

The train ride epiphany

Around 1980, after several years as a diamond polisher and the loss of his job at a factory that went out of business, Polnauer went to London to try to sell a parcel of diamonds. He didn’t manage to offload a single stone, but on the train, on the way back from his business meetings, he saw an advertisement in The Guardian for crown jeweler Garrard, featuring a pear-shaped, brown diamond. Using his abundance of “Israeli chutzpah,” he called the number and told them he had diamonds to sell. The managing director invited him to his office on Regent Street, where he told Polnauer he was making a tiara for a wedding and needed 106 pear-shaped diamonds in four weeks.

Despite his cheeky admission to our team that at the time he had never even heard of pear-shaped diamonds, Polnauer took on the challenge, flew to New York, and secured the stones needed for the piece. He brought them back to London, and Garrard, thrilled with the selection, cut him his first check for GBP 106,000, equivalent to about GBP 1 million ($1.3 million) today.

He used that experience to convince Graff to do business with him. At the time, the jewelry house worked with a sultan whose wife gifted every visitor to their palace with a diamond watch, and Graff was desperate for the pink and yellow diamonds needed to create 50 to 70 watches per year. And thus began Polnauer’s career in the colored-diamond business.

Changing with the times

Throughout the years, Polnauer has watched his business grow from diamond sourcing and manufacturing to include in-house designers that create custom pieces for clients whom they usually never meet face-to-face, but who nevertheless aren’t afraid to drop massive sums of money for a beautiful, original Leibish creation.

One of the most important lessons Polnauer has learned during his time in the colored-diamond industry is that people shop first by color, then by price tag. He has broadened his business to include colored gemstones, because if someone wants a blue diamond but can’t afford it, a sapphire or tanzanite can often present a compelling and cheaper alternative.

Most of the firm’s clients are wealthy 30- to 60-year-olds who have a penchant for color, because, as Polnauer notes, “color is excitement.” They purchase multiple pieces to match their clothing. One client in Texas bought 13 rings in a two-year period because she loved color. Meanwhile, another client ordered a ring for his wife, who then decided she needed earrings to match. When those were ready, she wanted a necklace to complete the set. Polnauer was more than happy to comply, and in a four-day time span, he saw his bank account padded with an additional $500,000.

But working in the colored-diamond industry isn’t always easy. Recently, the company was tasked with sourcing dozens of matching yellow diamonds to be used for a watch created by Jacob & Co. That search took the company on a two-year, international hunt before they finally filled the commission.

Other changes over his more than four-decade career have also been difficult. He has sadly watched as the Israeli diamond-manufacturing sector has diminished in importance with India’s growth, and learned the meaning of providing added value to customers.

“People used to just want to buy a stone, but now they want to buy a product,” he says. “You have to have an internet business; you have to manufacture jewelry. You also have to really be on point with your presentation. When business was face-to-face, if you screwed someone, he would just walk away upset. Now, with the internet, he doesn’t walk away. If he doesn’t like what he gets, he sends it back, and he writes a bad report about you on Google, and you have to pay for the return shipment, so presentation is crucial.”

No lab-grown zone

While many in the industry have welcomed the advent of lab-grown as a way to make money from clients who can’t always afford natural stones, Polnauer pulls no punches about his dislike of what he calls “fakes.”

He believes lab-grown to be detrimental to the natural-diamond industry, because the fall of synthetic prices “pulls down the price of real diamonds.”

He’s also not shy about making it known how damaging he thinks De Beers was with its marketing of lab-grown.

“De Beers made a tremendous self-destructive move by introducing a product which is undermining the basic product they sell,” he explains. “They cannibalized their own sales and did a tremendous disservice to the industry.”

However, Polnauer believes when it comes to lab-grown, there is a light at the end of the tunnel.

“Lab-grown is stealing the story from natural diamonds,” he says. “But there is a saying: ‘When the music stops, the dancing stops,’ so hopefully everything will work out for the best.”

Staying optimistic

His brazenness has seen Polnauer ride out many market ups and downs, the latest challenge being the Israel-Hamas war that started when the latter attacked the country on October 7. When asked if it’s affected his business, he says it has. While he notes that those who want to buy his products still will, and those who don’t never would have anyway, he believes the negative sentiment is “poison” for an industry based on “illusion and sentiment.”

Despite it all, he remains hopeful. When it comes to the future of the trade, he thinks “fancy-colored diamonds will flourish, gemstones will flourish and the jewelry market will flourish, because I’m an optimist, and if you put that positivity out there, everything will work out.”

Source: rapaport