Mountain Province Sales Slump in “Very Difficult” Conditions

Mountain Province Diamonds has reported a 42% drop in sales for FY2025, as "very difficult" market conditions

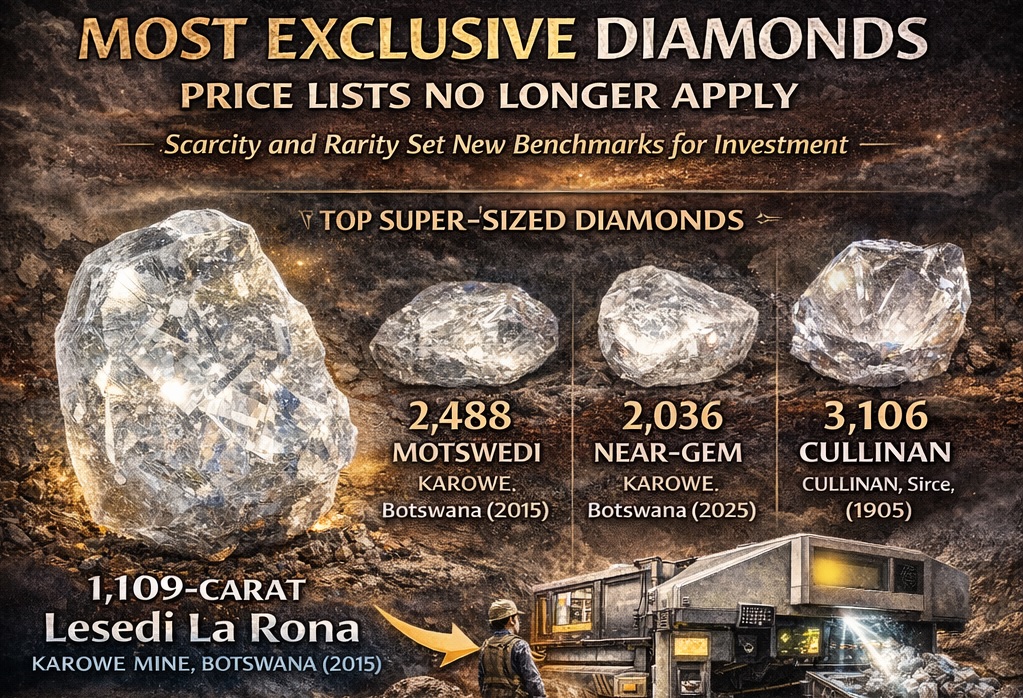

For the Market’s Most Exclusive Diamonds, Price Lists No Longer Apply

The Record-Breaking Diamonds report from the Natural Diamond Council (NDC) explores this ultra-high-end world, analysing the largest[…]

Iran War Halts Shipments Between India and Dubai

Iran has launched well over 1,000 drones and ballistic missiles at the UAE since 28 February in[…]

India Seeks to Strengthen Global Diamond Governance

Competition for scarce natural resources such as oil, gas, uranium, and critical minerals has historically played a[…]

Alrosa Profits up 88% Despite G7 Sanctions

Alrosa reported an 88% jump in its FY2025 profits, as it cut costs, improved efficiency, diversified into[…]

India’s Jewellery Exports and Diamond Imports Disrupted as Middle East Conflict Escalates

India’s gems and jewellery trade is facing significant disruption as the escalating conflict in the Middle East[…]

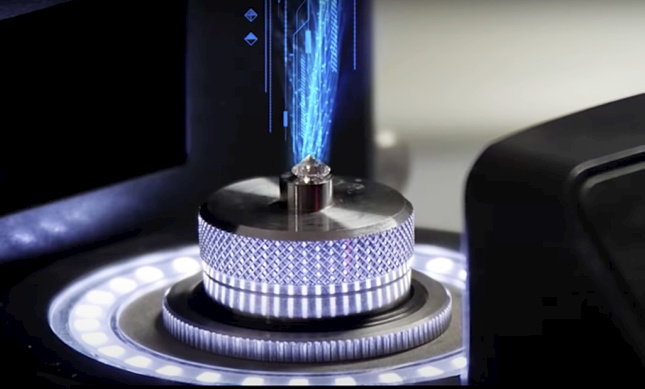

Sarine Could Diversify as Losses Hit $3.9m

Sarine reported a $3.9m loss for FY2025, as lab grown sales soared in the US and weak[…]

Diavik and First Nation sign closure agreement as diamond mine winds down

The Tłı̨chǫ government and Diavik diamond mine have signed a formal closure agreement as the Northwest Territories[…]

Belgian Diamonds Lose US Tariff Exemption as Trump Reimposes 10% Global Duty

The global diamond trade is facing renewed uncertainty after Belgian diamonds lost their US tariff exemption under[…]

Ekapa Mining Files for Liquidation Following Tragedy at Historic Kimberley Mine

South African diamond producer Ekapa Mining has filed for liquidation following a fatal mud rush at its[…]