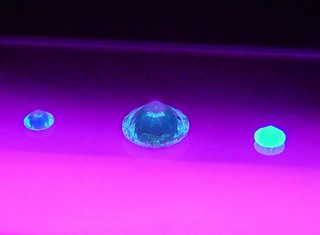

Diamond fluorescence

There is common misconception that a diamond exhibiting fluorescence under ultra violet light has some kind of[…]

Victor Mine To Be Closed By De Beers in 2019

Production will cease at the De Beers Victor mine in Canada in 2019

De Beers Will Close Four Namibian Diamond Mines

Due to resources dwindling Beers’ joint ventures will close four diamond mines by 2022.

Vivid Yellow Diamond Recovered By Alrosa

A 34.17 carat Fancy Vivid Yellow Rough Diamond was recovered by Almazy Anabara a mining company affiliate[…]

De Beers’ $370M Sight Reflects Slow Rough Market

De Beers’ October sight closed with a value of $370 million