Holiday Season: Modest Uptick in US Jewelry Sales

Jewelry sales in the US grew by 1.6 per cent during the 2025 holiday period, outpacing last[…]

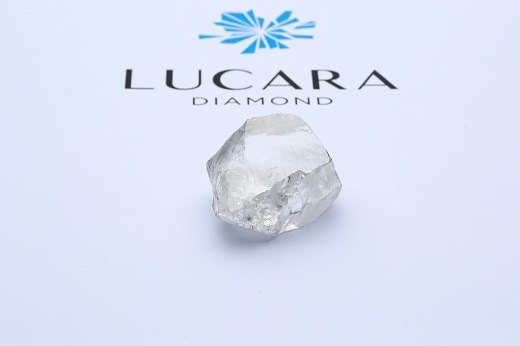

Lucara Advances Karowe Underground Expansion Despite Global Diamond Market Slump

Lucara Diamond Corp is moving forward with the underground expansion of its flagship Karowe mine in Botswana,[…]

Namibia’s Diamond Output Hit by Price Drops and Lab Growns

Namibia's rough diamond production fell by 3.5 per cent year-on-year during Q3 2025, as prices fell, demand[…]

Passenger Hid $280,000 Diamonds Inside Body

A passenger arriving on a flight into Mumbai was found to have $280,000 of diamonds concealed in[…]

Namibia: Gold and Uranium Earnings Overtake Diamonds

Namibia has, for the first time, earned more tax revenue from gold and uranium than from diamonds.

Record Watch and Jewellery Sales Mark Strong 2025 at Sotheby’s

Sotheby’s has reported a standout performance in 2025, with watch and jewellery sales delivering robust year-on-year growth.

3.63-ct “Salt and Pepper” Pink Fails to Sell

The highlight of Sotheby's Fine Jewelry sale in New York - a rare 3.63-carat fancy vivid purple-pink[…]

Childhood Friends Unearth $55,000 Natural Diamond in India

On a crisp winter morning in Panna, a historic diamond-mining region in central India, two childhood friends[…]

Graff Diamond Ring Steals the Show at Freeman’s Important Jewellery Auction

A spectacular Graff diamond ring emerged as the star lot at Freeman’s recent Important Jewellery auction in[…]

Alrosa Upbeat, Despite Tariffs and Lab Growns

Alrosa CEO Pavel Maryinchev gave a remarkably upbeat assessment of the natural diamond market, telling the Times of India (TOI) that the industry is adapting well to US[…]