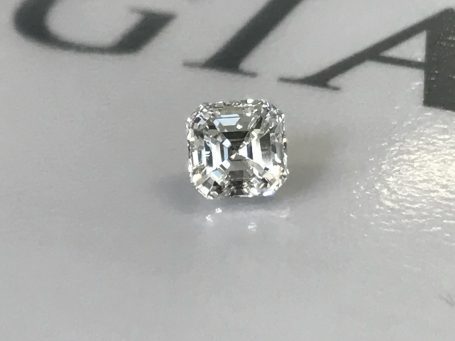

The Asscher Cut Diamond, A Royal diamond cut.

The Asscher Cut Diamond, A Royal diamond cut, With the most light return of all step cut[…]

Michael Hill’s US Sales Fall

Michael Hill’s US sales dropped in the past fiscal year as the Australia-based jeweler struggled in the[…]

Seven Diamonds Over 50 Carats Recovered By Lucapa

Lucapa Diamond Company announced Thursday it has recovered seven stones exceeding 50 carats

Brink’s Low Value Parcel Shipping

A better service and more secure way to send goods to the DCLA. Brink’s Low Value Parcel[…]

Diamonds are all billions of years old

How you can re-purpose your existing diamonds. DCLA helps you certificate and then DCLA Diamonds helps design[…]

Another large gem diamond recovered at Lesotho mine

Gem Diamonds found the high quality 126 carat, D colour Type IIa rock at Letšeng. Gem Diamonds[…]

Gem Diamonds finds two large rocks at flagship mine in Lesotho

Africa focused Gem Diamonds has discovered two diamonds bigger than 100 carats at its Letšeng mine in[…]

Kimberley Diamonds closes its last mine

Controversial Australia-based miner Kimberley Diamonds has put its last remaining diamond mine into administration after it failed[…]