Petra Diamonds suspends operations at its Tanzania mine

The Tanzanian governments confrontational approach to miners operating in the country including Petra Diamonds, has led[…]

Bespoke Diamond Jewellery

DCLA Diamond Exchange one off handmade, commissioned jewellery. Handmade Jewellery is produced in Sydney Australia

Zimbabwe ruling elite linked to disappearing diamonds

Top security and political leaders steeling Zimbabwe's diamond reserves anti-corruption group alleges.

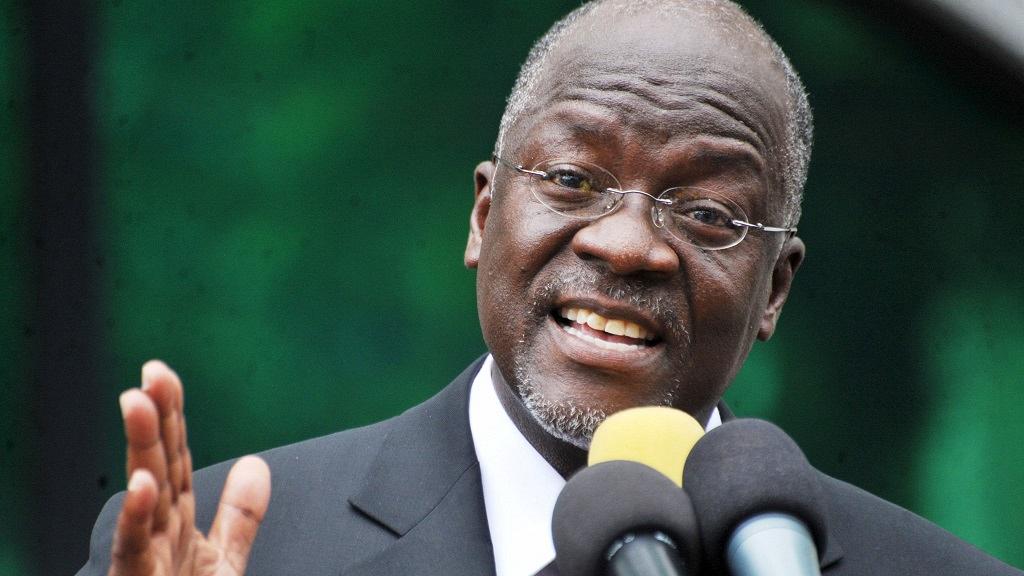

Tanzania confiscates diamonds from British mining company

The Tanzanian government has announced the seizure of diamonds worth an estimated $29.5 million after accusing British[…]

Classic car prices drop but diamonds and wine shine

Old Master paintings and classic cars have lost the luster, But the uber rich have seen their[…]

Diamond stockpiles Increase In Indian Companies

A US slowdown in demand for polished diamonds is gradually building up inventories at Indian jewellery[…]

Diamond Futures Exchange Launches In India

To help the Diamond industry limit losses when polished prices fluctuate. The Indian Commodity Exchange has launched[…]

De Beers Raises Marketing Budget to USD $140M

De Beers marketing spend this years is more than $140 million, This is the biggest De Beers[…]

Taylor Swift’s diamond filled bathtub

In Taylor Swift's new music video for "Look What You Made Me Do." The pop star is[…]

Sarine Technologies moves into Diamond Grading

Sarine Technologies the world leader in diamond measuring and assessing is expanding its diamond report. It will[…]