International Diamond Manufacturers Association

The International Diamond Manufacturers Association (IDMA) is a global trade organisation that represents the interests of diamond[…]

Industrial Grade Diamond

An Industrial Grade Diamond refers to a diamond that does not meet the standards required for use[…]

International Diamond Council

The International Diamond Council (IDC) is a global organisation that was established to create and maintain standardised[…]

Ideal Cut

The term Ideal Cut refers to a diamond that is cut with proportions and angles that maximise[…]

Indented Natural

An Indented Natural refers to a specific type of natural feature found in diamonds. It is a[…]

Hue

In the diamond grading system, hue refers to the specific colour or shade that a diamond displays,[…]

Hot Laser Inscription

Hot laser inscription refers to the process of using a high-powered laser beam to inscribe a number,[…]

HPHT (High Pressure High Temperature) Treatment

HPHT treatment refers to a method used to alter or enhance the colour of diamonds through the[…]

Heart Cut

The heart cut is one of the most romantic and symbolic diamond shapes, often chosen for engagement[…]

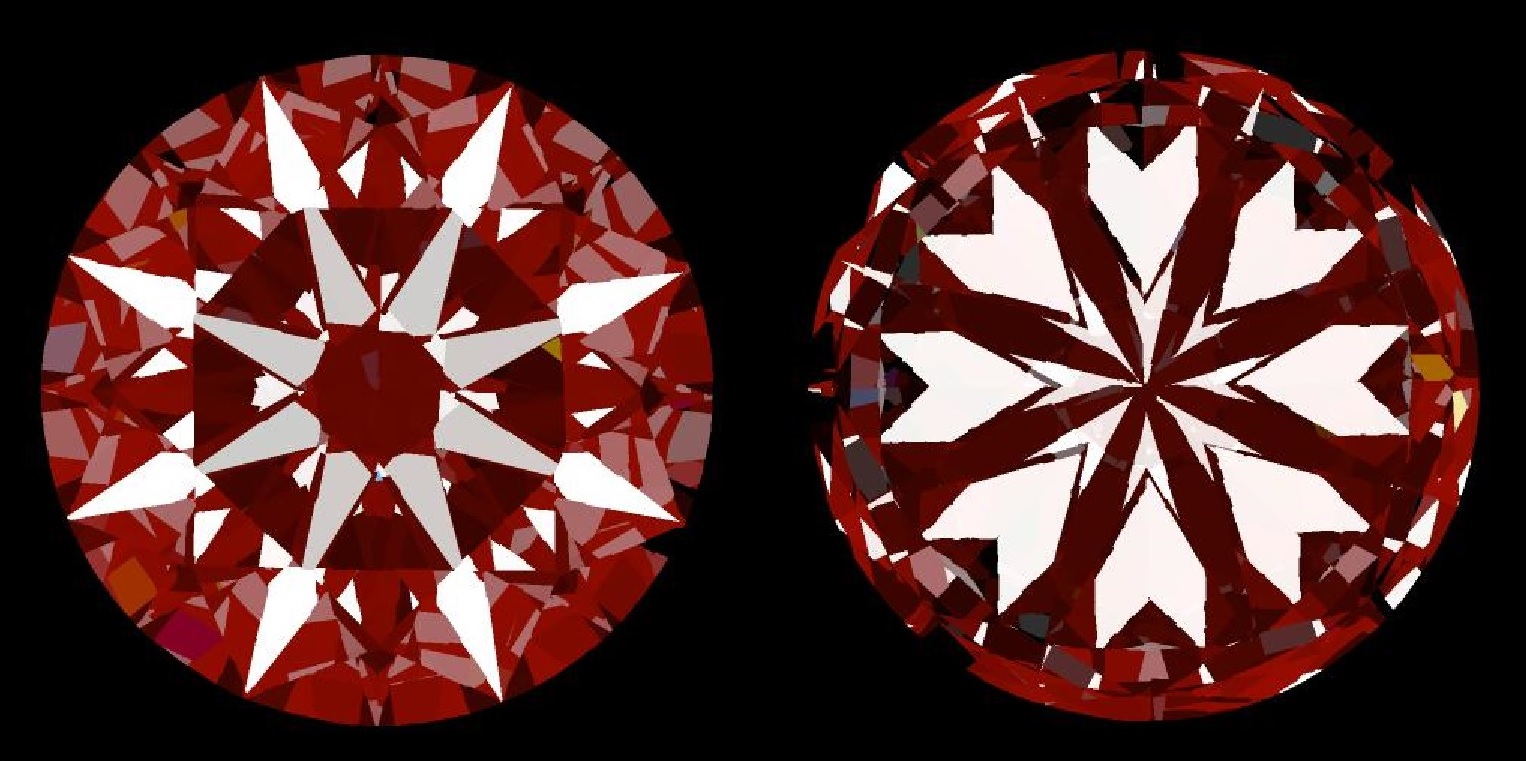

Hearts & Arrows

The term Hearts & Arrows refers to a distinct and beautiful pattern that appears in some high-quality[…]