De Beers is allowing its diamond buyers to refuse some lower-quality stones at its sale this week, according to people familiar with the situation.

It’s a rare move by De Beers, which is famous for requiring buyers to take what’s offered, and highlights the weak state of the low-end diamond market. The diamond miner made a similar gesture in 2016, when India’s move to ban high-value currency notes depressed demand.

Prices for cheaper stones, which are often small and low quality, have fallen in recent years. The market has been hurt by too much supply, lower profit margins in major cutting centers such as Surat in India and the depreciation of the Indian rupee. There’s also new competition from man-made gems, such as De Beers’s Lightbox brand.

The buyers, known in the industry as sightholders, will still have to purchase their quota of gems before the end of the year, said the people, who asked to not be identified because the sales are private. By delaying their purchases, buyers are hoping that demand will pick up during the gift-giving festival of Diwali, a Hindu celebration in early November.

De Beers, which is 85 percent owned by Anglo American Plc, operates mines across southern African and Canada. It sells diamonds at 10 sales a year in Botswana to a select group of customers. The buyers are expected to specify the number and type of diamonds they want, and then carry out the purchases at a price set by De Beers. If they reject too many gems, they risk losing their place in the sales.

Source: bloomberg.com

Lesotho focused miner Namakwa Diamonds will sell a 29.59 carat, fancy pink rough stone in Antwerp this fall.

The company discovered the diamond at its KAO mine in the African country on June 12, according to brokerage firm Bonas Couzyn, which will facilitate the sale.

The stone named the Rose of KAO will appear in Antwerp for viewings from September 17 to 28, and bidding in an online tender will close October 1. The auction is part of the fourth sale of KAO goods this year.

Namakwa owns and operates the KAO mine through its subsidiary, Storm Mountain Diamonds. The asset has a record of producing fancy color diamonds.

The miner recovered the 36.06 carat Pink Storm in December 2013, and sold it the following month.

Source: Diamonds.net

The Liquidated Ellendale mine in Western Australia, known for its fancy yellow diamonds is back on the market.

The Ellendale mine claimed to have yielded around half of the world’s supply of rare yellow diamonds during peak production.

Ellendale mine is located 120km east of Derby was also the main supplier of fancy yellow diamonds for luxury jewelry retailer Tiffany & Co.

Mining company Vast Resources gained access to a section of Zimbabwe’s Marange fields with a view to developing joint operations there with a local community group.

The miner reached an agreement with Red Mercury, a subsidiary of the Marange-Zimunya Community Share Ownership Trust, to carry out due diligence over a two-month period at the Heritage Concession – a 15-square-kilometer area in the Marange fields.

If the concession proves viable, the companies will form a joint venture for exploration, mining and marketing diamonds from the site. Such a partnership would see Red Mercury provide the government-issued mining license, and Vast responsible for procuring funding to develop a mine.

The deal would fall in line with Zimbabwe’s indigenization laws, which require 51% ownership by a designated entity or community-share ownership trust. That law is currently under review, and could change in the next few months, Vast Resources noted.

“Having already agreed on the principal terms of the future joint venture with the MZ Community Trust, we have confidence that once the due-diligence period is complete, subject to final results, we can move swiftly in building a valuable diamond arm of our business, which is mutually beneficial for all stakeholders,” added Andrew Prelea, CEO of Vast.

Earlier this year, Vast signed a memorandum of understanding with Botswana Diamonds to develop Zimbabwe’s diamond resources and share information from past exploration of the region.

“I am delighted Vast has been awarded this exclusive access to part of the famous Marange diamond fields, and we look forward [to] working with them to realize the full potential of this area and others as they begin to emerge with Zimbabwe opening for business,” said Botswana Diamonds chairman John Teeling.

Source: Diamonds.net

India’s diamond exports to the United States of America is under threat after that country’s Federal Trade Commission (FTC) announced last month that there would henceforth be no distinction between natural and man made sparklers.

The FTC had originally defined a diamond as “a natural mineral consisting essentially of pure carbon crystallized in the isometric system”. The definition has now been modified with the word “natural” removed from it. The FTC went on to say that the definition of a diamond was being changed because it was now possible to create diamonds in a laboratory. “These stones have essentially the same optical, physical and chemical properties as mined diamonds.

Thus, they are diamonds,” FTC’s statement said. Lab-grown diamonds or “American diamonds”, as they are called, are expected to receive a big boost since the US is one of the biggest markets in the world for smaller diamonds. According to diamond traders here lab-grown diamonds are almost 40 per cent cheaper than those mined from the bowels of the earth.

It is felt that continuing technological advances in the field will bring down the price of lab-grown diamonds even more in the coming years. India, which exported $8 billion worth of polished diamonds to the US in 2017, is worried. “We are already been reaching out to different industry bodies and stakeholders to help fashion a common global response,” Sabyasachi Ray, Executive Director, Gem and Jewellery Export Promotion Council said in a statement here last week.

The country’s apex body of gem and jewellery exporters went on to say that it was not opposed to synthetic or lab-grown diamonds. “We have always maintained that it can be developed as a separate vertical that is not confused with the natural diamond pipeline,” Ray added.

Source: tribuneindia

A stuck ring can simply be the result of wearing a ring that’s too small. It can also be caused from arthritis of joints, which can happen as your body changes over the years. This can cause the joints and/or tissue to swell, which prevents you from removing your ring.

When you can’t simply slide your ring off, try these steps for safely removing a ring:

- Squirt some Windex – yes Windex – on the finger and ring. Or, use any lubricant such as soap or oil.

- Elevate the hand overhead for 5-10 minutes with ice around the ring and finger.

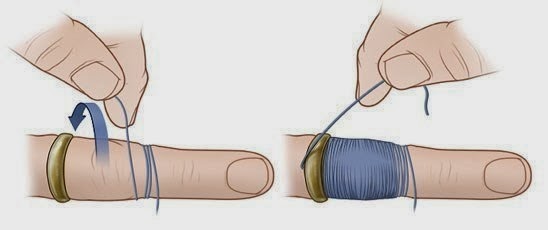

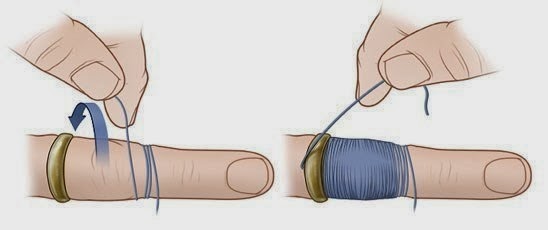

- Use dental floss or a thread to compress the swollen finger as shown:

a. Slip the thread or floss under the stuck ring with the bulk of it toward the fingertip.

b. Beginning at the top of the ring, snuggly wrap the finger with the thread/floss around and around, compressing the finger, all the way up and over the knuckle.

c. With the end that was under the ring, begin to unwrap the thread or floss with the ring sliding over the knuckle as you go.

*If all else fails, cut the ring off with a ring cutter found in jewelry stores, fire departments and emergency rooms.

See video: https://www.youtube.com/watch?v=KJHUAwEx1bY

Source: assh.org

Alrosa the world’s largest diamond miner, will hold an auction for the sale of special size rough diamonds weighing over 10.8 carats in Israel from August 19 to September 6.

The company will auction 202 gem quality rough diamonds with a total weight of 3,165 carats. About 100 companies from Israel, Belgium, India, Hong Kong and Russia were invited to participate in the auction.

“The end of summer is traditionally a good time for auctions the demand for rough diamonds is growing. It is also relevant for Israel where our goods are always in demand and most local companies specialize in large size rough diamonds. According to all these factors we made changes to our plans and increased the number of stones for the sale. Now we look forward to a high demand for our diamonds and good results of the auction,” said Evgeny Agureev, a Member of the Executive committee, Director of the USO ALROSA.

Under Russian law, diamonds of special sizes weighing over 10.8 carats can only be sold at auctions.

ALROSA will hold another auction in Israel in November.

Source: IDEX Online

Africa focused Gem Diamonds must be getting used to recovering huge precious rocks from its flagship Letšeng mine in Lesotho, as it has just dug up another massive one.

The 138 carat, top white colour Type IIa diamond is 12th diamond over 100 carats the company finds this year, beating the 11 it dug up in 2015.

The largest diamond found this year is a 910 carat D colour type IIa diamond, about the size of two golf balls, which was named the “Lesotho Legend.” It became the second largest recovered in the past century and sold for $40 million at an auction in March.

Since acquiring Letšeng in 2006, Gem Diamonds has found now five of the 20 largest white gem quality diamonds ever recovered, which makes the mine the world’s highest dollar per carat kimberlite diamond operation.

At an average elevation of 3,100 metres above sea level, Letšeng is also one of the world’s highest diamond mines.

The biggest diamond ever found was the 3,106 carat Cullinan, dug near Pretoria, South Africa, in 1905. It was later cut into several stones, including the First Star of Africa and the Second Star of Africa, which are part of Britain’s Crown Jewels held in the Tower of London.

Lucara’s 1,109 carat Lesedi La Rona was the second biggest in record, while the 995 carat Excelsior and 969 carat Star of Sierra Leone were the third and fourth largest.

Source: mining.com

The Gemological Institute of America (GIA) has identified a stone comprising two halves of a diamond that had been stuck together with an “unknown adhesive.”

Graders noticed a large fracture and cavity on the table of the marquise-cut, 1.38-carat polished diamond submitted to the GIA’s laboratory in Carlsbad, California, for colored-diamond testing. When the gemologists examined the crack under a microscope, they noticed a gap running down the stone from the crown to the pavilion, as well as a slight misalignment in the facets and air bubbles inside the fracture.

The polish lines on the stone’s facets would have linked if there hadn’t been a fracture, GIA gemologist Troy Ardon explained this month in a lab note in the latest edition of Gems & Gemology. For that reason, gemologists determined that the stone had been broken in half after it was at least partially polished, and then repaired with an unidentified adhesive.

“Diamonds have been adhered together with glue to form a diamond-doublet, but a broken diamond that has been repaired was not something previously reported by GIA,” Ardon added.

The GIA couldn’t grade the diamond because the 4Cs wouldn’t apply to it, the note continued. A carat weight would have been meaningless, as it would have comprised the weight of both halves plus the adhesive.

Image: Robison McMurtry/GIA

Source: diamonds.net