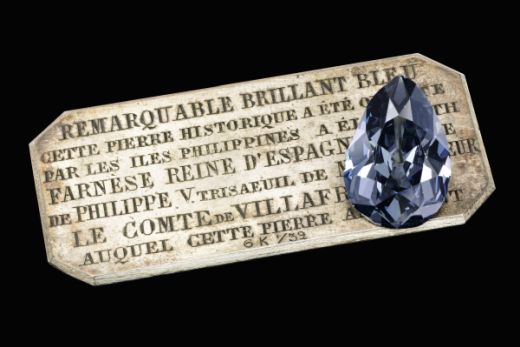

Sotheby’s will offer the historic Farnese Blue diamond at its Geneva sale in May, the first time it has been on the market.

The pear-shaped, 6.16-carat, fancy dark grey-blue stone — originally given to Queen Elisabeth Farnese of Spain as a wedding gift following her marriage to King Philip V in 1714 — has spent 300 years in the private collection of Europe’s royal families. The diamond will go under the hammer at the Magnificent Jewels and Noble Jewels auction on May 15 with an estimated price of $3.7 million to $5.3 million. Originating in the Golconda mines of India, it has traveled from Spain to France, Italy and Austria over the last three centuries.

The family kept the diamond in a secret royal casket, and, other than family members and the royal jewelers, no one knew of its existence.

“With its incredible pedigree, the Farnese Blue ranks among the most important historic diamonds in the world,” said Philipp Herzog von Württemberg, chairman of Sotheby’s Europe and managing director of Sotheby’s Germany.

Queen Elisabeth passed the Farnese Blue to her son Philip, duke of Parma, whose son Ferdinand inherited it and passed it to his son Louis I, king of Etruria. Louis’s grandson, Charles II, duke of Lucca, passed it to his grandson, Robert I, the last ruling duke of Parma, who took the stone from Italy to Austria. He then mounted the stone on a diadem that had belonged to his mother, Louise Marie Thérèse of Artois. Upon the death of Robert I, the stone passed to his son Elias of Bourbon, duke of Parma. His wife, Maria Anna von Habsburg — who died in 1940 — recorded the stone’s history.

The Farnese Blue will appear at Sotheby’s in Hong Kong, London, New York, Singapore and Taipei, before coming to Geneva for display prior to the sale.

Source: diamonds.net