South Africa’s Petra Diamonds is considering selling its Williamson mine in Tanzania, even as it continues to work on bringing the operation back online in the second half of 2021.

Delivering its year-end results, Petra said that Williamson had been classified as a discontinued operation, which will mean an accounting loss of $52.1 million for the company. The mine was mothballed in April last year after diamond prices dropped following the global covid-19 outbreak.

BMO analyst Raj Ray said that while a sale could be viewed positively by the market, he sees potential risks in terms of realizing the value of $84 million (net book value of about $26 million at F2021 year-end) the bank ascribes to the asset, given the recent challenges.

“Recent efforts to procure a $25 million working capital facility with a local bank for the restart have so far been unsuccessful,” Raj wrote in a note to investors.

Petra has faced allegations of human rights abuses at the mine, resulting from the actions of its security guards.

The miner formed in February an internal committee to oversee the investigation, which concluded that “regrettable” incidents did take place at the mine in the past. Shortly after, it reached a £4.3 million (about $6m) settlement with claimants, even though it did not admit liability.

The company is currently engaged in talks with the Tanzanian government over a revised regulatory framework, which would lead to Williamson’s re-opening.

A key issue in those discussions concerns a parcel of 71,654 carats of diamonds effectively placed in limbo after deceased President John Magufuli blocked their export in 2017.

Turnaround

Despite covid-19 and issues at Williamson, Petra has staged a sharp turnaround in fortunes over the past financial year. It cut net debt by two-thirds in the year ended June 30 after a capital restructuring completed in March and rising sales drove strong growth in free cash flow.

Petra ended fiscal 2021 with net debt of $228 million, down from just under $693 million last year. Net profit reached $196.6 million, reflecting a $213.3 million gain after the successful debt restructuring.

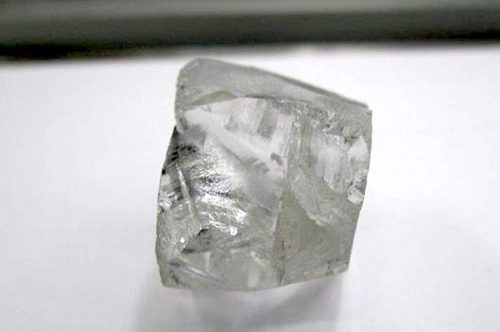

Revenue rose 65% to $402.3 million on the back of higher sales of exceptional stones.

As for fiscal 2022, Petra reaffirmed production guidance of 3.3 million-3.6 million carats, with capital expenditure of $78 million- $92 million.

Source: Mining.com