Clarity Enhancement

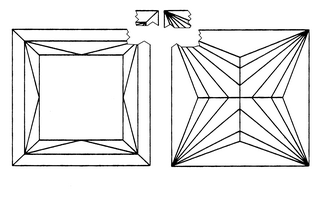

Clarity enhancement in diamonds refers to the process of improving the appearance of a diamond by reducing[…]

Chameleon-Type Diamond

Chameleon diamonds typically shift from an olive green or grayish-green hue to a yellow or orangey-yellow shade[…]

Champagne Diamond

A champagne diamond is a type of fancy-coloured diamond that exhibits a warm brown hue with subtle[…]

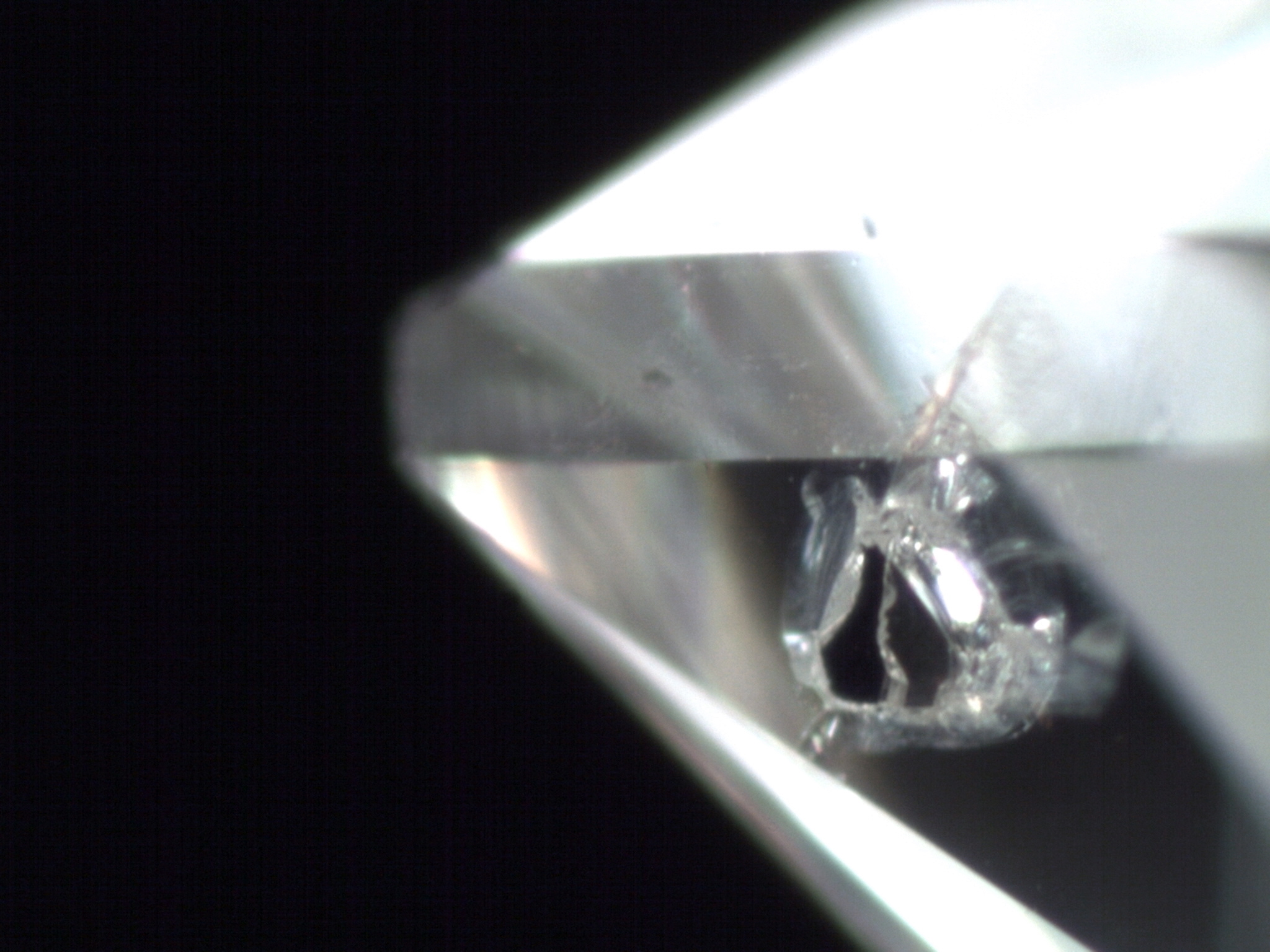

Cavity

Type of diamond inclusion that appears as an opening or large indentation on the surface of a diamond

Certificate

A diamond certificate, also known as a diamond grading report, is an official document issued by a[…]

Carbon

Diamonds are made of pure carbon, but their unique atomic structure is what gives them their remarkable

Carbon Spots

Small black graphite inclusions in a diamond are a type of natural impurity that occurs during the[…]

Canary Diamond

A Canary Diamond is a highly sought-after type of fancy yellow diamond known for its rich, intense[…]