Colour

Diamond Colour is one of the most important factors in determining a diamond’s quality and value. DCLA[…]

Coloured Diamond

A coloured diamond is a diamond that exhibits a hue other than the traditional colourless range.

Coated Diamond or Coating

A coated diamond refers to a diamond that has undergone a treatment where a thin layer of[…]

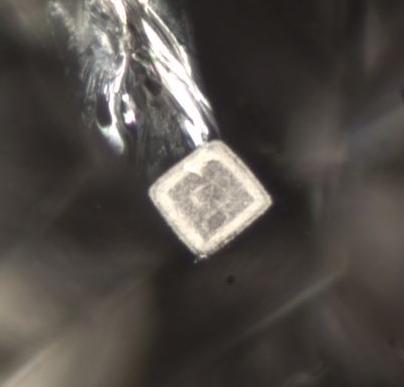

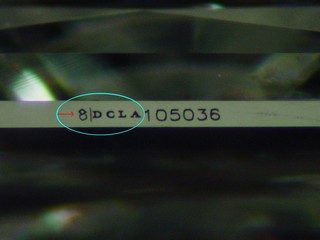

Cold Laser Inscription

A diamond cold laser inscription is a process where a laser is used to etch a unique[…]

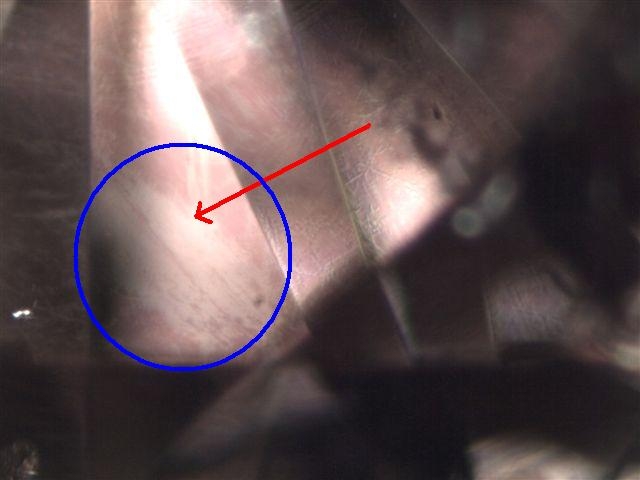

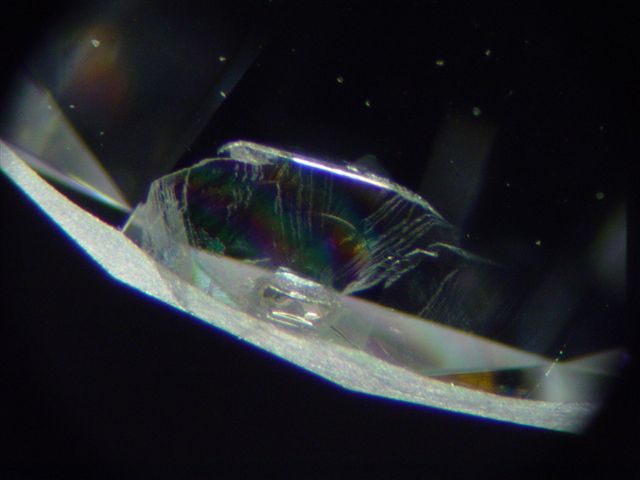

Cleavage

Cleavage in a diamond refers to the ability of a diamond to split or fracture along specific[…]

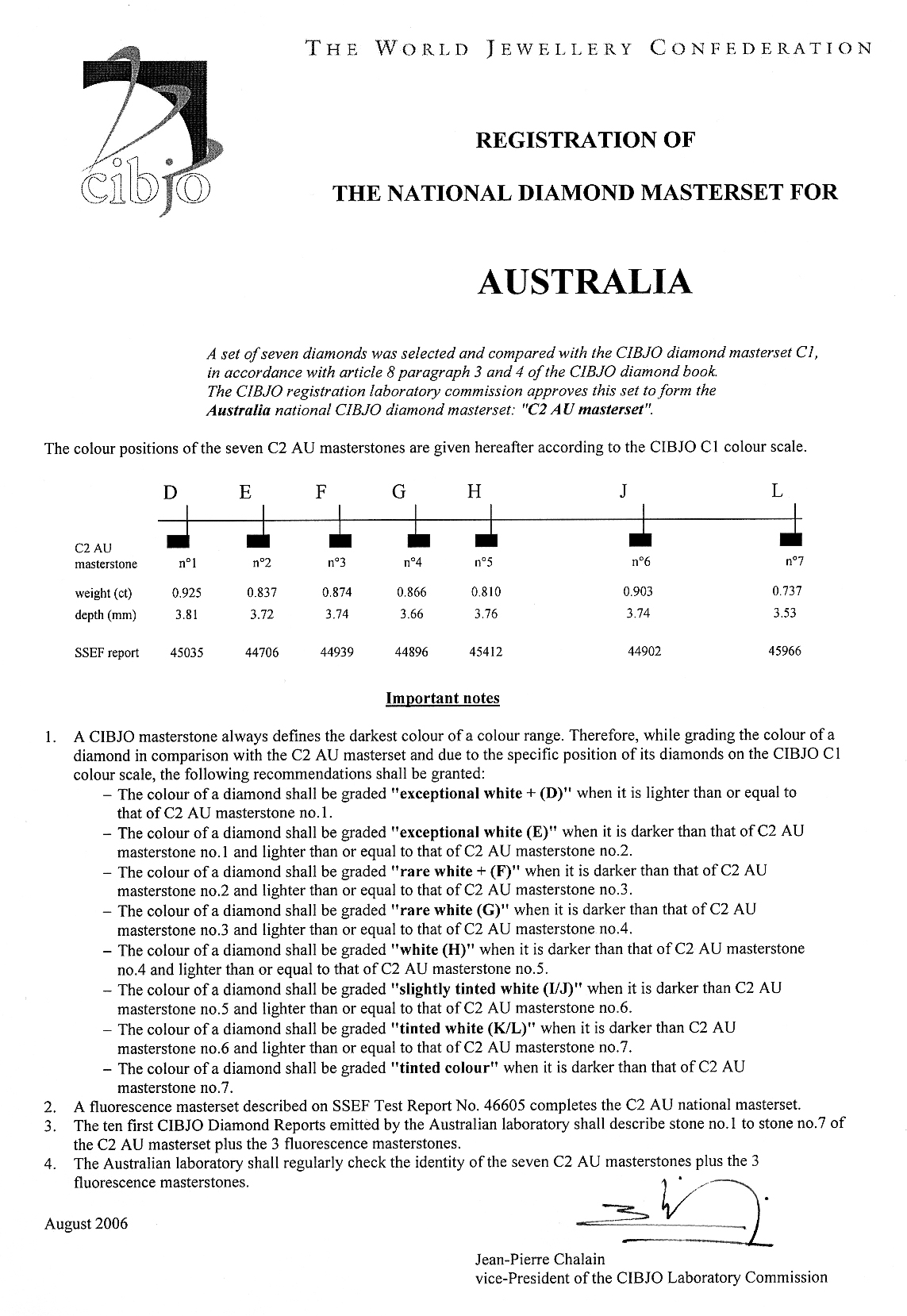

CIBJO

CIBJO, also known as The World Jewellery Confederation, is a global organization that represents the jewellery industry.[…]

Clarity

Diamond clarity refers to the presence and visibility of inclusions (internal flaws) and blemishes (external flaws) within[…]