Diavik and First Nation sign closure agreement as diamond mine winds down

The Tłı̨chǫ government and Diavik diamond mine have signed a formal closure agreement as the Northwest Territories[…]

Belgian Diamonds Lose US Tariff Exemption as Trump Reimposes 10% Global Duty

The global diamond trade is facing renewed uncertainty after Belgian diamonds lost their US tariff exemption under[…]

Ekapa Mining Files for Liquidation Following Tragedy at Historic Kimberley Mine

South African diamond producer Ekapa Mining has filed for liquidation following a fatal mud rush at its[…]

Botswana Diamonds rebrands, targets copper

Botswana Diamonds (LON: BOD) will rebrand as Botswana Minerals and trade under the new ticker BMIN from[…]

What Is Lab-Grown Gold? (And What It Really Means for Jewelry)

ab-grown gold is often used as a marketing term to simply refer to recycled or recovered gold.[…]

How to Clean a Diamond Ring at Home – Expert Advice from DCLA Diamond laboratory

Has your engagement ring lost its brilliance? Don’t worry—your diamond hasn’t lost its sparkle. It simply needs[…]

De Beers Reports $511 Million Loss as Global Diamond Crisis Deepens

Despite generating approximately $3.5 billion in revenue, profitability deteriorated sharply, highlighting a widening disconnect between stable turnover[…]

Halle Berry Follows Celebrity Trend for Vintage Diamonds

Halle Berry shifted the focus back to vintage diamonds with her latest engagement ring.

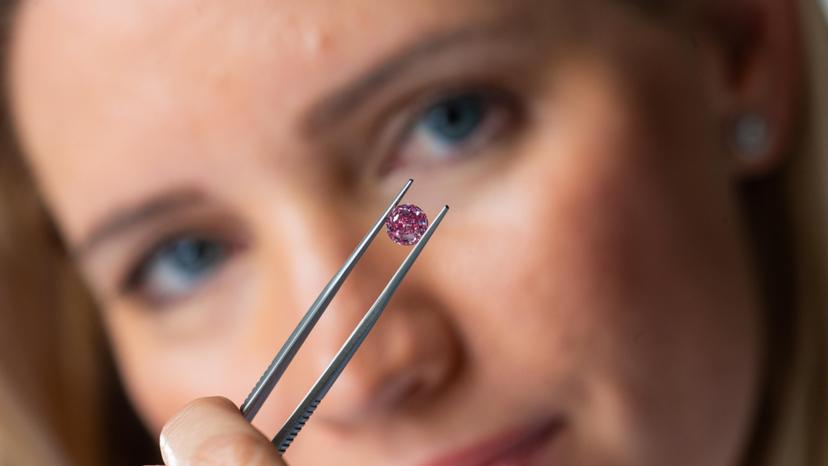

What Is a Diamond? Natural vs Laboratory-Grown – Structure, Science and Pricing

A diamond is a solid form of the element carbon in which the atoms are arranged in[…]