India Seeks to Strengthen Global Diamond Governance

Competition for scarce natural resources such as oil, gas, uranium, and critical minerals has historically played a[…]

Alrosa Profits up 88% Despite G7 Sanctions

Alrosa reported an 88% jump in its FY2025 profits, as it cut costs, improved efficiency, diversified into[…]

India’s Jewellery Exports and Diamond Imports Disrupted as Middle East Conflict Escalates

India’s gems and jewellery trade is facing significant disruption as the escalating conflict in the Middle East[…]

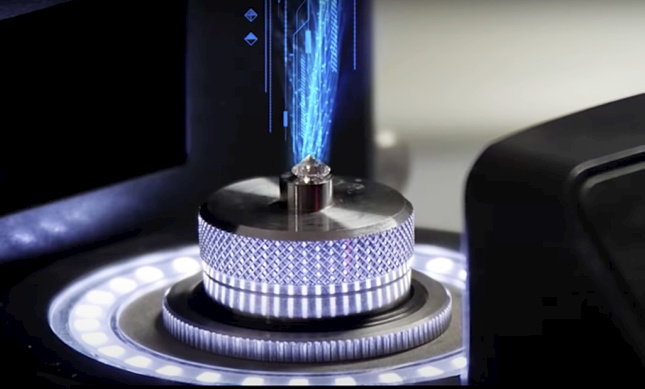

Sarine Could Diversify as Losses Hit $3.9m

Sarine reported a $3.9m loss for FY2025, as lab grown sales soared in the US and weak[…]

TAGS FEBRUARY 2026 DUBAI MARKET & TENDER REPORT

There appears to be an improvement in both overall mood and confidence amongst buyers this month. We[…]

Diavik and First Nation sign closure agreement as diamond mine winds down

The Tłı̨chǫ government and Diavik diamond mine have signed a formal closure agreement as the Northwest Territories[…]

Belgian Diamonds Lose US Tariff Exemption as Trump Reimposes 10% Global Duty

The global diamond trade is facing renewed uncertainty after Belgian diamonds lost their US tariff exemption under[…]

Ekapa Mining Files for Liquidation Following Tragedy at Historic Kimberley Mine

South African diamond producer Ekapa Mining has filed for liquidation following a fatal mud rush at its[…]

Botswana Diamonds rebrands, targets copper

Botswana Diamonds (LON: BOD) will rebrand as Botswana Minerals and trade under the new ticker BMIN from[…]

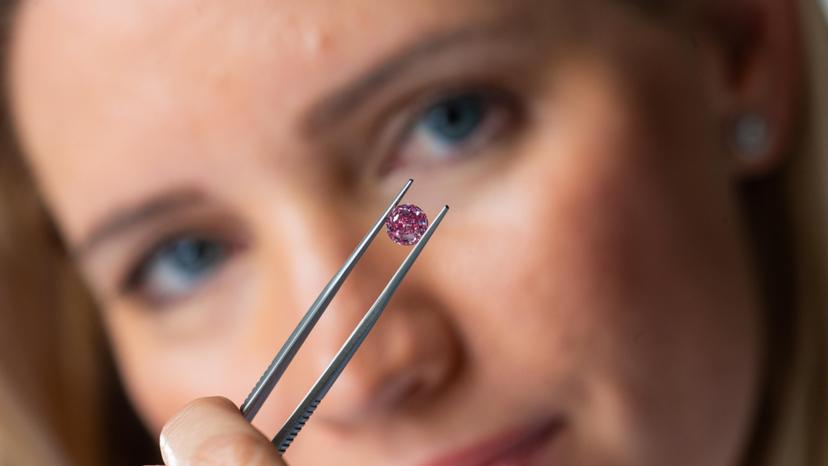

What Is Lab-Grown Gold? (And What It Really Means for Jewelry)

ab-grown gold is often used as a marketing term to simply refer to recycled or recovered gold.[…]