Botswana Diamonds picks up high potential kimberlite pipe in South Africa

Botswana Diamonds has been awarded the priority 2.5 ha Mooikloof kimberlite pipe concession

Zimbabwe Forecasts Surge in Diamond Output

Zimbabwe’s rough diamond production output will grow at an average of 21% per year from 3 million[…]

D1 Mint buys 1500 investment quality diamonds for new diamond backed crypto coin

Investment grade diamonds

Petra Diamonds needs to raise $178 million to urgently cut debt

Mining firm Petra Diamonds said it aims to raise $178 million to help cut its debt burden

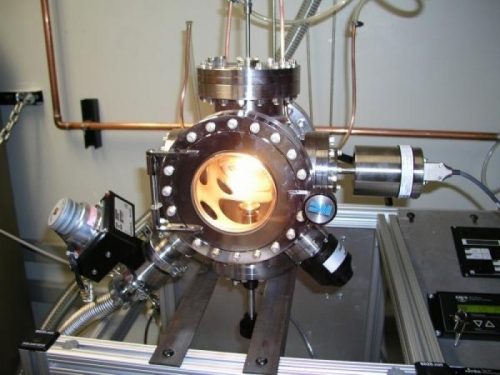

HOW TO BUY A LABORATORY GROWN DIAMOND

NEX diamonds are type 2A diamonds the best laboratory created diamonds