India’s Jewellery Exports and Diamond Imports Disrupted as Middle East Conflict Escalates

India’s gems and jewellery trade is facing significant disruption as the escalating conflict in the Middle East[…]

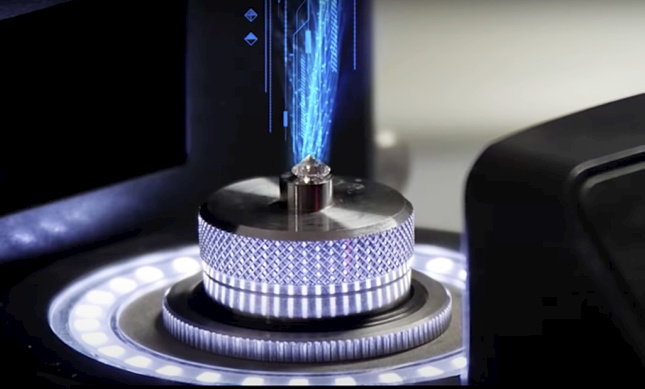

Sarine Could Diversify as Losses Hit $3.9m

Sarine reported a $3.9m loss for FY2025, as lab grown sales soared in the US and weak[…]

TAGS FEBRUARY 2026 DUBAI MARKET & TENDER REPORT

There appears to be an improvement in both overall mood and confidence amongst buyers this month. We[…]

Belgian Diamonds Lose US Tariff Exemption as Trump Reimposes 10% Global Duty

The global diamond trade is facing renewed uncertainty after Belgian diamonds lost their US tariff exemption under[…]

Ekapa Mining Files for Liquidation Following Tragedy at Historic Kimberley Mine

South African diamond producer Ekapa Mining has filed for liquidation following a fatal mud rush at its[…]

Botswana Diamonds rebrands, targets copper

Botswana Diamonds (LON: BOD) will rebrand as Botswana Minerals and trade under the new ticker BMIN from[…]

How to Clean a Diamond Ring at Home – Expert Advice from DCLA Diamond laboratory

Has your engagement ring lost its brilliance? Don’t worry—your diamond hasn’t lost its sparkle. It simply needs[…]

De Beers Reports $511 Million Loss as Global Diamond Crisis Deepens

Despite generating approximately $3.5 billion in revenue, profitability deteriorated sharply, highlighting a widening disconnect between stable turnover[…]

Halle Berry Follows Celebrity Trend for Vintage Diamonds

Halle Berry shifted the focus back to vintage diamonds with her latest engagement ring.