De Beers Confirms 2026 Sight Dates and Cuts Rough Diamond Prices as Global Market Pressures Intensify

De Beers has released its 2026 sight schedule, confirming it will maintain its traditional 10 rough diamond[…]

The Farnese Blue Diamond: Three Centuries Through Europe’s Royal Courts

The Farnese Blue occupies a rare position among historic natural diamonds. It is not merely a gemstone[…]

Diamond Industry Pioneer Louis Glick Passes Away at 102

Louis “Louie” Glick, one of New York’s most respected diamond dealers and a pioneering force behind the[…]

Petra Recovers Huge 41.82-ct Blue Diamond

Petra Diamonds today announced the recovery of a huge 41.82-carat Type IIb blue diamond at its Cullinan[…]

De Beer’s 1873 Diamond, Still in Kimberlite

An extremely rare relic from the earliest years of the Kimberley diamond rush - a rough stone,[…]

Global Diamond Industry Shows Signs of Recovery: What Is Driving the Rebound?

After three challenging years marked by geopolitical disruption, shifting trade routes, and weakened consumer confidence, the global[…]

FOREVERMARK DIAMOND JEWELLERY CELEBRATES THE GRAND OPENING OF DE BEERS GROUP’S LARGEST FLAGSHIP STORE IN MUMBAI

Mumbai, 8th January 2026: Forevermark Diamond Jewellery marked a defining milestone in its India journey with the[…]

Holiday Season: Modest Uptick in US Jewelry Sales

Jewelry sales in the US grew by 1.6 per cent during the 2025 holiday period, outpacing last[…]

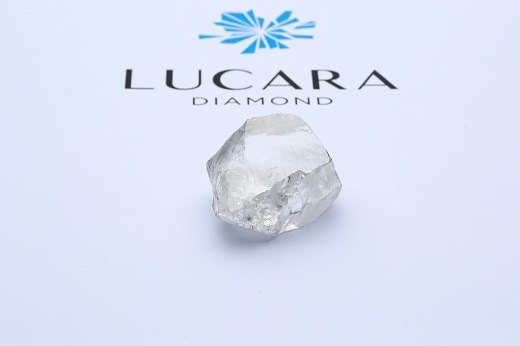

Lucara Advances Karowe Underground Expansion Despite Global Diamond Market Slump

Lucara Diamond Corp is moving forward with the underground expansion of its flagship Karowe mine in Botswana,[…]

Namibia’s Diamond Output Hit by Price Drops and Lab Growns

Namibia's rough diamond production fell by 3.5 per cent year-on-year during Q3 2025, as prices fell, demand[…]