Angola Diamond Mines Generate $1.8 Billion in Revenue Despite Pricing Pressures

Angola’s diamond sector delivered a robust production and sales performance in 2025, generating approximately $1.8 billion in[…]

Petra Recovers Huge 41.82-ct Blue Diamond

Petra Diamonds today announced the recovery of a huge 41.82-carat Type IIb blue diamond at its Cullinan[…]

De Beer’s 1873 Diamond, Still in Kimberlite

An extremely rare relic from the earliest years of the Kimberley diamond rush - a rough stone,[…]

Global Diamond Industry Shows Signs of Recovery: What Is Driving the Rebound?

After three challenging years marked by geopolitical disruption, shifting trade routes, and weakened consumer confidence, the global[…]

FOREVERMARK DIAMOND JEWELLERY CELEBRATES THE GRAND OPENING OF DE BEERS GROUP’S LARGEST FLAGSHIP STORE IN MUMBAI

Mumbai, 8th January 2026: Forevermark Diamond Jewellery marked a defining milestone in its India journey with the[…]

Holiday Season: Modest Uptick in US Jewelry Sales

Jewelry sales in the US grew by 1.6 per cent during the 2025 holiday period, outpacing last[…]

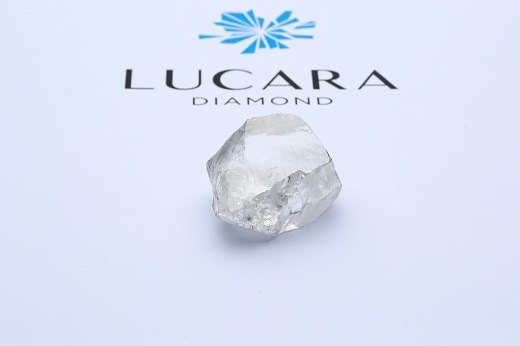

Lucara Advances Karowe Underground Expansion Despite Global Diamond Market Slump

Lucara Diamond Corp is moving forward with the underground expansion of its flagship Karowe mine in Botswana,[…]

Namibia’s Diamond Output Hit by Price Drops and Lab Growns

Namibia's rough diamond production fell by 3.5 per cent year-on-year during Q3 2025, as prices fell, demand[…]

Passenger Hid $280,000 Diamonds Inside Body

A passenger arriving on a flight into Mumbai was found to have $280,000 of diamonds concealed in[…]

Namibia: Gold and Uranium Earnings Overtake Diamonds

Namibia has, for the first time, earned more tax revenue from gold and uranium than from diamonds.